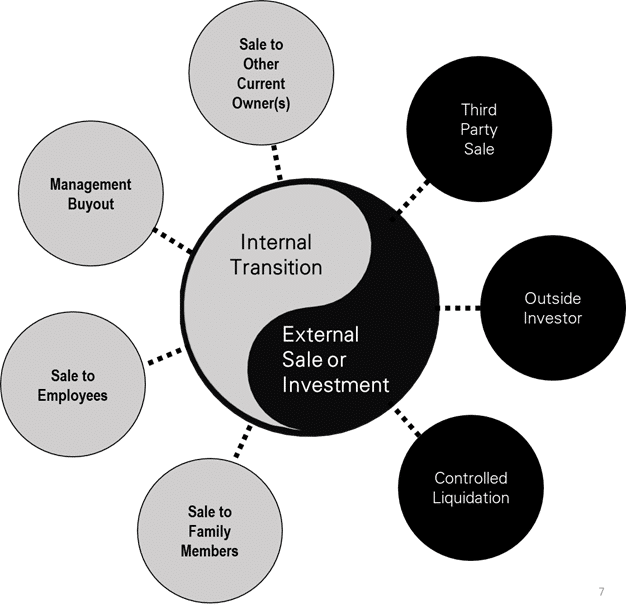

When a business owner starts to evaluate what is an exit strategy for their business there are many options available to them. Some are internal. Some are external.

External options are typically the sale to a 3rd party or a partial sale to an outside investor. Internal options include selling to another current owner, a management buyout, selling to employees, such as in an ESOP, or selling to a family member. Internal transitions are typically different in focus than external sales. The sale of a business to a third party focuses on maximizing net proceeds, while internal sales is often more focused on assuring the continuance of the business and transition to the new internal owners.

Management Buyout

A Management Buyout – often referred to as an MBO – occurs when the management team in a business is able to secure funds to purchase the business from the current owner or owners. Management uses the assets of the business to finance a significant portion of the purchase price. The balance is often financed by the owner through an owner note.

The advantages of a management buyout include continuity of the business, highly motivated buyers, a controlled exit planning process and keeping important human capital in the firm.

The disadvantages of a management buyout include the distraction that occurs inside the business, the possible threat of flight by the owner, the possibility of the owner attempting to over-value the business, lack of funds to finance the transition, and the likelihood of a lower price to the owner than would be generated through a 3rd party sale.

One potential issue is that the management team may not be as good at the current owner at growing the business and making the right top-level business decisions. This is important if the owner has to provide owner financing to accomplish the transaction.

Selling to Employees Through an ESOP

Selling the company through an Employee Stock Ownership Plan, referred to as an ESOP, is a practice that has been used over several decades to successfully transfer ownership to employees. It is potentially applicable to businesses that have at least 30 employees. The ESOP is typically financed by a lending institution specializing in ESOP financing.

A company is an ideal candidate for an ESOP if the owner is approaching retirement, if the management team is capable of running the business after the owner leaves, if the company has unused debt capacity, and company profits can support the ESOP debt service. An ESOP can also be used to buy-out a minority shareholder and can be a valuable approach when there are limited 3rd party buyers available.

Advantages to selling a company through an ESOP are: The Business stays in the “Family”, is purchased with Pre-Tax Dollars, is an employee benefit and often causes the employees to think more like owners. Historically ESOP owned companies out-perform their competition versus non-ESOP owned companies. Taxable Gains on ESOP Shares May Be Deferred under certain circumstances.

Selling to an Existing Partner

If there are multiple owners in the business, the sale of ownership from one owner to one or more other owners may be an attractive option. Success is closely linked to the existence and quality of a buy-sell agreement.

The advantages of this approach are that this strategy can be less disruptive to the business, it can be planned well in advance, and it can be lower in implementation costs. If a well constructed Buy-Sell Agreement is in place between the owners, then the process to accomplish this is already defined.

If there is a poorly defined Buy-Sell Agreement or no Buy-Sell Agreement, then the process can become difficult and confrontational, and the business valuation will likely become a source of disagreement.

The disadvantages of this approach include potential discord, a lower sale price, and realization of the proceeds may be slower due to owner financing. If a Buy-Sell Agreement already exists, it may restrict selling options. Another issue is whether the departure of the owner will create competency gaps in the remaining management team.

Transferring Ownership to the Family Members

Intergenerational or family transfers of the business are typically accomplished between parents and the next generation of children. Unfortunately, many owners have found that transferring the business to the next generation is more difficult than they expected. Also, an important factor is in today’s business environment is that many children do not have interest in continuing in the family business.

The advantages of an intergenerational family transfer include it preserves the business legacy, it is typically lower in cost, it can be easily planned, it gives more control over the exit process, it is less disruptive to the business, and it can generate high motivation from both the seller and the buyer.

The disadvantage of a family ownership transfer is that is may involve considerable family dynamics, typically has a lower valuation than a third-party sale, often lacks adequate funds to finance the transfer, may cause key employees to leave the company, and maintaining historical tradition may prevail over implementing new growth strategies that may be needed in the business.

Sale to a Third Party

Sales to a third party can be accomplished directly by the owner, although engaging a professional mergers and acquisitions advisor will likely secure higher offers for the business. The process to market and sell a business has many steps and many potential pitfalls. There are eight steps to selling a business:

- Defining Your Sale Objective

- Sale Strategy and Planning

- Research and Analysis

- Materials Preparation

- Sales and Marketing

- Active Buyer Engagement

- Negotiation and Closing

- Post-Closing Activities

So when an owner is evaluating what is an exit strategy for their business, they have many choices available to them. The owner should reach out to professional exit planners and their current business advisors to learn more about these options. They can also learn more about these processes by going to The Exit Architect Academy, a platform designed to education business owners about exit planning.