There are three ways that a business owner can grow their business.

- They can focus on actions that directly impact their bottom line. This includes increasing pricing and reducing spending.

- They can focus on factors that improve the attractiveness of their business to potential buyers. Most of these factors relate to reducing specific risks and therefore increasing the multiple that a potential buyer is willing to pay for their company.

- They can purchase another company, resulting in the increase in both revenues and profits.

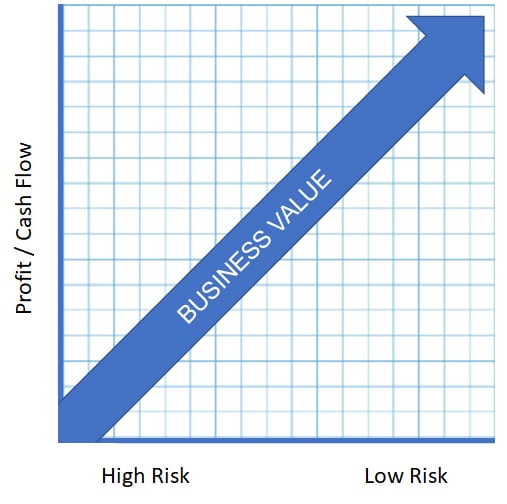

The relationship of business value, profit and risk is shown in the chart below.

Too much risk and a company has no value to a prospective buyer. Too little profit and cash flow also results in lack of interest. This relationship exits whether you are the seller or the buyer.

Lets take each of the three strategies to grow your business and expand on each of them separately.

Number 1: Increasing the bottom-line result.

This results from several actions.

First a company should carefully evaluate their current pricing and increase prices wherever possible. Prices should be increased incrementally over time. Many companies make the mistake of waiting too long and then implement price increases in large amounts. This strategy is much more likely to generate negative responses from your customers than by implementing price increases incrementally over time.

Driving down product or service costs and improving gross margins. If you are a product-based business, then negotiate cost reductions from your suppliers or bring on lower cost suppliers. Also focus on selling products with higher margins, which will improve your overall gross margin percentage.

If you are a service-based company look at automation, developing repeatable and more cost-effective processes, or outsource the service to lower cost providers.

Next focus on lowering operating costs. This might include controlling a variety of discretionary operating expenses or analyzing utility, telecommunication, office supplies and other similar costs. There are outside companies that provide this service, often charging only a share of the savings that they generate. Look at rental or building operating costs to determine if this can be reduced or controlled at the company grows.

Number 2: Improving the attractiveness of the business.

The attractiveness of a business can be measured in the multiple that a prospective buyer is willing to pay for a business. This is almost always related inversely to the amount of risk, as was shown earlier in the business value graph.

This risk factors include several factors that have been proven to be related to the multiple of a business. These factors include:

- Dependency of the business on the owner

- Concentration of customers

- Loyalty of your customer base

- The repeatability of your customer purchases

- Dependency on single source suppliers

- Your company’s ability to scale

- Dependency on specific employees

Number 3. Purchasing another company.

Purchasing another company can be a valuable way to grow your business, improve bottom line performance and increase the multiple that a prospective buyer is willing to pay for your business.

Although there are certainly risks in buying another company, the rewards often outweigh these risks.

No matter which of these three options you decide to implement, it is important to reach out to experts in these areas to help you maximize the impact on your company’s valuation. We are here to help you in your journey.

This information and much more about how to grow your business is contained in The Exit Architect Academy. Click HERE to learn more about how the Exit Architect Academy can benefit you.