The need for buy-side transactions can be driven by a variety of reasons, including:

- You are leaving another company as an employee and want to own and run your own business.

- Your investment strategy includes the purchase of a company as way to generate wealth.

- You are looking to purchase a company synergistic to one you already own as a way to increase the overall value of your combined companies.

- You are looking to purchase a company for another family member to manage and/or eventually own.

- You are looking to diversify your business investments.

- You have sold a company and want to use part of the proceeds to purchase another company.

- You want to use debt leverage to purchase another company as a way to generate wealth.

- You want to purchase a non-profit company.

Regardless of the reason, the process for purchasing a business is fairly similar from one transaction to the next.

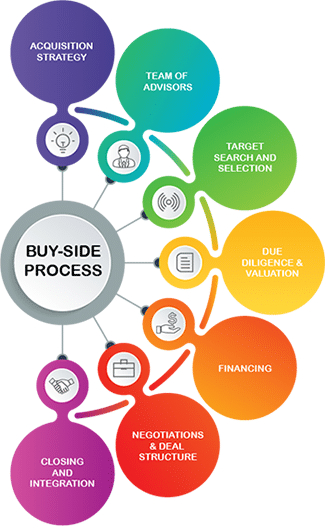

A Buy-Side Transaction can include some or all of these steps:

- Determining your targeted market and business and developing a strategy for finding the targeted business.

- Securing advice from professional service providers, including merger and acquisition professionals.

- Conducting a marketing campaign to all parties that may have knowledge about businesses that might be available in your targeted markets and/or direct outreach to targeted businesses.

- Initial evaluation of prospective businesses and narrowing the prospects and conducting more in-depth analysis, including meeting with the prospective business owners.

- Securing financing.

- Negotiating all considerations and deal terms.

- Closing the transaction and conducting post-closing activities.

Purchasing of a company takes both time and patience. Sellers often say they are willing to sell, but aren’t or over value their businesses. Even with cooperative sellers, due diligence may reveal risk issues that cannot be overcome, attractive financing may not be available, legal issues may prevent the sale or other issues arise that make the transaction not viable.

Working with multiple targets has its advantages, but increases the effort required. It may also increase transaction expenses, particularly if accounting fees, legal or other fees are involved.

One of the issues in buy-side transactions is whether to target active versus passive sellers. To learn more about this topic please select Active vs Passive Sellers.