One example exit strategy for a small business might be useful is to consider a buy, then sell strategy. The benefit of this strategy is that an acquisition of similar size or smaller business can increase the overall value of the combined businesses by increase the business valuation multiple. It has been shown in many studies that larger companies sell at a higher multiple for the following reasons:

- Larger companies are considered less risky to purchase than smaller companies.

- Larger companies typically diverify the risks of any business.

- Larger companies can have the advantage of operational and expense efficiencies.

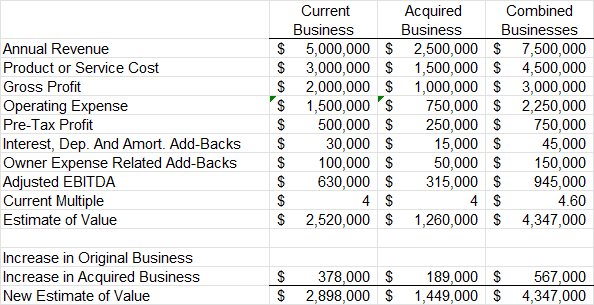

This reduction in risk translates to a higher multiple and therefore higher value. An example is show below:

In this example exit strategy for a small business is a $5M annual revenue business purchases another company half their size. Both companies make 10% pre-tax profit and have similar owner expense related add-back when calculating Adusted EBITDA.

In this example, a 15% improvement in multiples for both companies is used as the estimated impact of generating a larger combined company. The result is a combined improvement of $567K due to the higher multiple. Moreover the estimated business value has grown from $2.5M to $4.35M.

Of course, buying another company involves risks and would likely require financing of the transaction. But let’s say that the first business had available cash of $1.3M to purchase the second company and sold both companies within 2 years after acquiring the 2nd company. The return would be $567K on $1,260K or 22.5% per year. Using financing to accomplish the acquisition via a leveraged transaction would increase the returns even higher. Also offering a larger company for sale might be the difference from being able to sell a business or not being able to sell a business.